Estonia, 11th Jun 2024 – In the whirlwind of today’s financial markets, staying ahead requires innovative strategies. Enter Algorithmic Trading — where intricate algorithms dictate trading decisions with a speed and frequency far surpassing human capabilities. At the vanguard of this revolution stands MoonTrader, boasting an avant-garde auto-trading system poised to redefine trading strategies.

Understanding MoonTrader’s Algorithmic Trading

The MoonTrader terminal epitomizes advanced trading automation. It employs sophisticated algorithms to execute trades based on predetermined criteria. This system optimizes performance while mitigating emotional biases that often plague manual trading.

Key Features

- User-Friendly Interface: Despite its complexity, MoonTrader’s interface is intuitive, making it accessible for novices and seasoned traders.

- Customizable Algorithms: Tailor the algorithms to fit your trading style and risk tolerance. Whether you’re a day trader or a long-term investor, MoonTrader adapts to your needs.

- Real-Time Market Scrutiny: Continuously monitors market conditions, adjusting real-time strategies to maximize profitability.

- Lightning-Fast Execution: Executes trades within milliseconds, ensuring no market opportunity is missed.

Benefits of Utilizing MoonTrader’s automated trading

- Increased Efficiency: Automates trades, reducing the need for constant market monitoring.

- Enhanced Precision: Algorithms eliminate human errors, ensuring precise trade execution.

- 24/7 Trading: Exploit market opportunities around the clock, even when you’re away.

- Risk Management: Implement advanced risk management strategies to safeguard capital and optimize returns.

Advanced Strategies in MoonTrader Terminal

Designed for professionals, MoonTrader provides exceptional opportunities to develop custom algorithms based on individual strategies. Here are some advanced techniques:

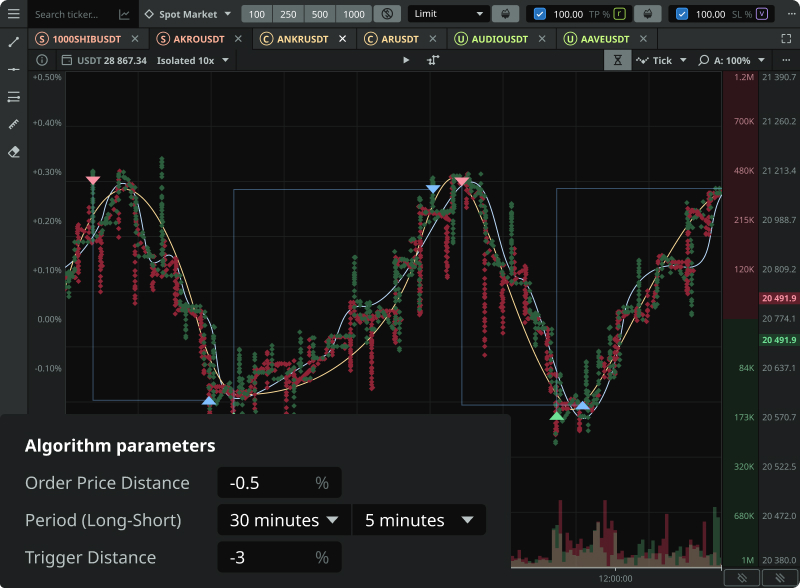

- Averages Strategy: This strategy analyzes the average price over a specific period. The bot buys when the current price is below the average and sells when above it, leveraging mean reversion with the assumption that prices will revert to their average over time.

- Shots Strategy: The bot participates in short-term trading by taking advantage of abrupt changes in prices. It purchases when prices sharply drop and sells during rapid rebounds in order to profit from temporary price fluctuations. To take advantage of these changes, the bot maintains open orders at set distances from the current price.

- Depth Shots Strategy: A refined version of the Shots strategy, incorporating additional data analysis for precise entry and exit points, considering deeper market insights.

Getting Started

Integrating MoonTrader’s auto-trading into your routine is seamless. Visit MoonTrader’s official page to explore features, pricing, and setup instructions. The platform offers comprehensive support and resources to help you effectively set up and customize your trading algorithms.

Conclusion

As financial markets continue to evolve, adapting your trading strategies is paramount. MoonTrader’s auto-trading offers a powerful solution to enhance trading performance with unparalleled speed, precision, and efficiency. By utilizing advanced strategies such as Shots, Depth Shots, and Averages, you can tailor your approach to meet your specific requirements. Embrace the future of trading and explore the vast possibilities with MoonTrader today.

Media Contact

Organization: MTSS Development OU

Contact Person: Evghenii

Website: https://www.moontrader.com/

Email: Send Email

Country: Estonia

Release Id: 11062413047

The post Unlocking the Future of Trading: A Profound Insight into MoonTrader’s Algorithmic Prowess appeared first on King NewsWire. It is provided by a third-party content provider. King Newswire makes no warranties or representations in connection with it.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Biz Economics journalist was involved in the writing and production of this article.